Automatic Mileage Tracker for Taxes | IRS Compliant GPS Log Book for Car Business & Work

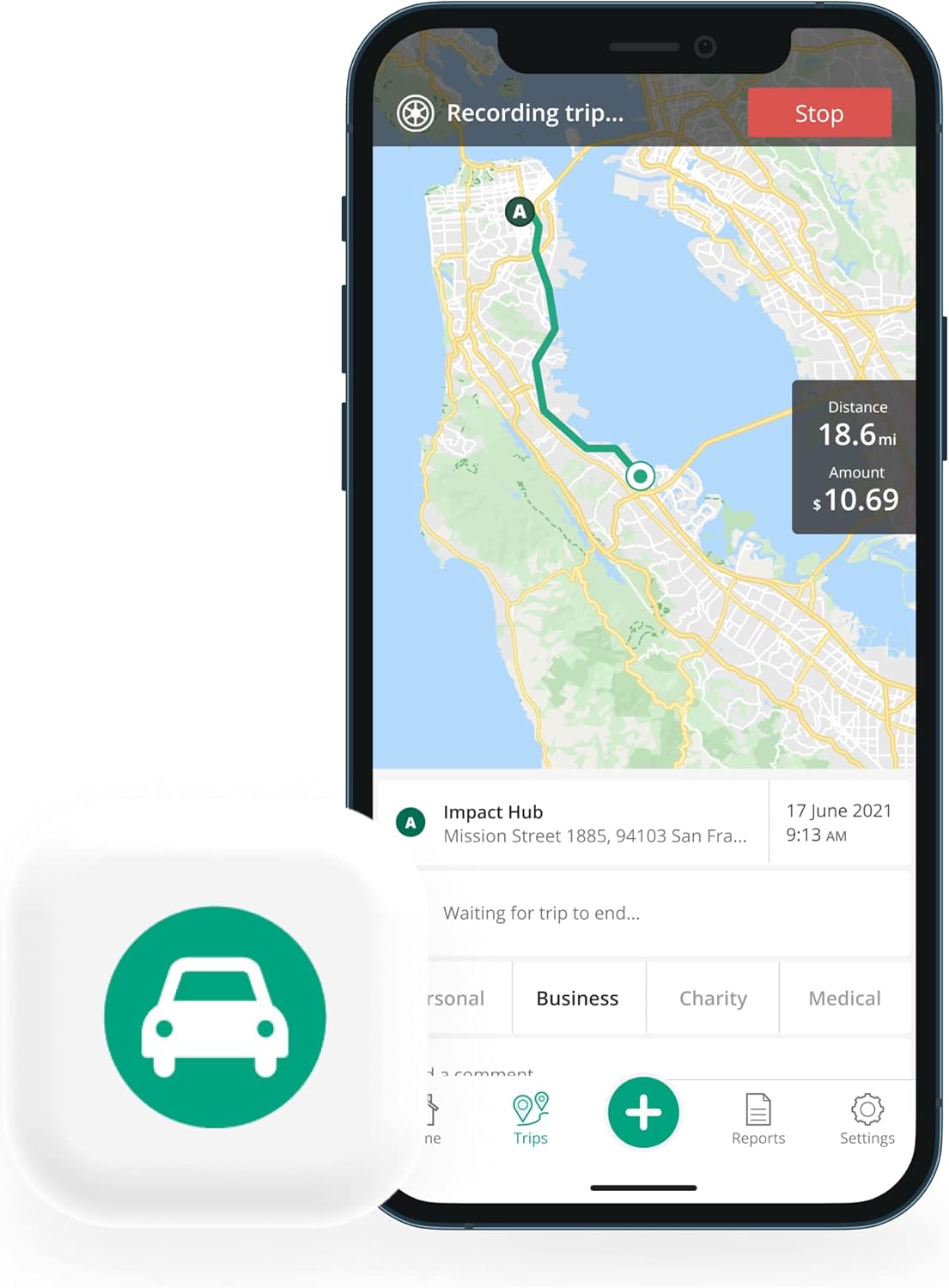

Stop manually tracking miles and start saving time on your taxes. Our automatic car GPS mileage tracker is the IRS-compliant solution for freelancers, small business owners, real estate agents, rideshare drivers, and anyone who drives for work. The app runs seamlessly in the background on your smartphone, using GPS to automatically log every business trip with start/end times, locations, miles driven, and a mapped route. This creates a detailed, IRS-acceptable mileage log that substantiates your tax deductions, maximizing your refund and protecting you in case of an audit. Key features include one-tap trip classification (business vs. personal), automatic IRS mileage rate calculations, detailed reporting, and secure cloud backup. You can export professional reports or directly share logs with your accountant. We offer a robust free plan to get started, plus premium subscription plans that unlock advanced features like automatic trip suggestions, receipt scanning, and multi-vehicle tracking. Ditch the spreadsheet and the notepad. Simplify your record-keeping, ensure full IRS compliance, and accurately claim every deductible mile you drive. Download the app today and transform your phone into a powerful automatic mileage log book for your car.